⏱ 4 min

Internal audit can make a valuable contribution when it comes to managing companies’ sustainability activities in the best possible way. Why is this becoming more and more important? How can internal audit support the achievement of sustainability goals, and what are the benefits? In this article, we explore these questions.

Importance of sustainability for companies

It isn’t just since the recent climate protests and conferences that sustainable business has been a hot topic. Companies have always striven to create long-term value and success. Now, though, the relationship between sustainability and companies is in the process of change. Not so long ago, the primary expectation of businesses was to generate profits, create jobs, pay taxes and comply with the law; today they are increasingly expected to meet standards other than purely economic requirements. This can include implementing environmental protection measures that go beyond legal obligations or taking a targeted stance on controversial issues such as paternity leave. Decades of corporate scandals have also triggered a crisis of trust in how society views companies. They are increasingly being denounced as the main cause of social, environmental and economic problems. The economy is sometimes even accused of flourishing at the expense of ordinary people. Such developments influence the business environment of many Swiss companies.

Shifting business environment

To secure long-term success, companies must take the changing expectations of their various stakeholder groups into account. Increasingly, customers’ purchasing decisions are directly determined by sustainability considerations. The perceived sustainability of a company defines whether and how much a customer is willing to pay for a product or service. This is reflected, for example, in consumers’ readiness to pay for organic and meat substitute products, clothing or even financial products with a focus on sustainability. The same focus can also increasingly be observed among professional candidates in the labour market. If a company’s values do not mirror a candidate’s own, this can be reason enough to turn down a job. At the same time, investors are incorporating sustainability criteria more and more into their investment decisions. This can be seen, for example, in the doubling of sustainable investments in Switzerland between 2018 and 2020 alone. [1] Last but not least, legislators have also begun to tighten their requirements for companies. In December 2021, the Federal Council adopted regulations on the better protection of people and the environment. A first draft of the Corporate Sustainability Reporting Directive (CSRD) was presented by the European Commission in April 2021. [2] Sustainability is moving rapidly from ‘nice to have’ to a required standard – an absolute must. In light of these changes, companies that start to examine their sustainability approach now stand to benefit in various ways.

Current developments

Some companies have already anticipated the sustainability trend and, for example, carried out materiality analyses or developed sustainability strategies as part of their sustainability reporting. These allow us to determine non-financial key performance indicators, including, for example, energy and water consumption or greenhouse gas emissions. In addition, climate risks and their financial impacts are increasingly subject to analysis, much in the same way as traditional risk management. However, there is still great potential for improvement on sustainability issues in the business world. Of the approximately 250 companies listed on the SIX Swiss Exchange, only 31 have currently declared their commitment to sustainability reporting by voluntarily opting in. [3] However, the Credit Suisse SME survey on reactions to the COVID-19 crisis revealed that 26% of Swiss SMEs intend to step up their efforts in the area of sustainability in the next one to three years. [4]

Internal audit as the key to long-term success

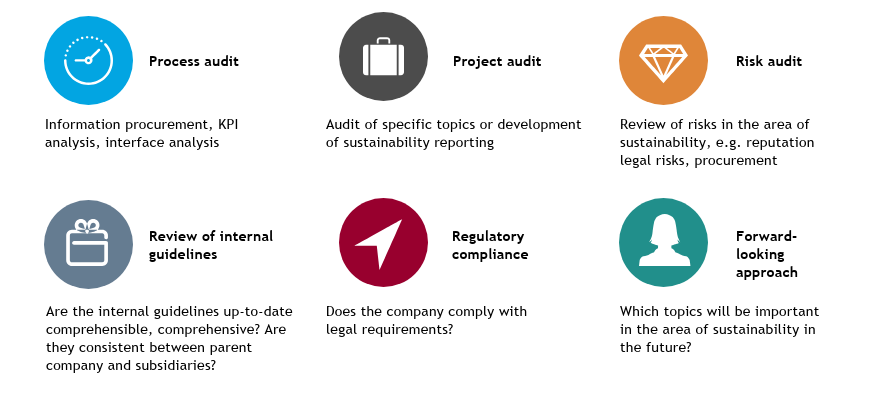

A systematic analysis of a company’s sustainability status is an essential starting point for companies wishing to survive on the market and succeed in creating value. In addition to a clear strategy, internal audit is increasingly emerging as a critical factor in the implementation of sustainability targets. A future-proof internal audit is one that includes the review of sustainability issues alongside the previous traditional areas. And there are numerous benefits to be reaped. Processes and procedures around sustainability are improved, which creates direct added value for companies and customers alike. For example, the typical process and project audits of old can also be applied in the area of sustainability, enabling organisations to identify potential for optimisation and development within business activities and processes. A well-founded risk audit also significantly increases the probability that sustainability risks will be flagged at an early stage. [5] This is especially relevant since risks in this area are currently among the most probable and influential. [6] One measure, for example, would be to check whether internal guidelines are up to date and consistent, taking care not to neglect the increasingly complex legal requirements. Of course, it always helps to anticipate tomorrow's issues today. A forward-looking approach enables important future trends to be identified and utilised.

[1] Swiss Sustainable Investment Market Study 2021, Swiss Sustainable Finance, Link.

[2] Overview of current developments in sustainability reporting: Link.

[3] Sustainability Reporting. SIX. As of December 2021. Link.

[4] Credit Suisse SME Survey 2020, p. 23. Link

[5] (DeSimone et al., 2021, p. 568)

[6] The Global Risk Landscape. World Economic Forum. Link

Sustainability in internal audit

Safeguard and optimise corporate sustainability through effective internal audit

Link: BDO Services

Conclusion

In conclusion, expanding the scope of internal audit to include sustainability issues helps companies to make their efforts more targeted and efficient. In individual cases, however, this is rarely as simple as it seems. As your partner, we will be pleased to work together with you and help you meet this challenge with our expertise.

Sources

1 | Swiss Sustainable Finance (SSF): Swiss Sustainable Investment Market Study 2021. Link.

2 | BDO: Overview of current developments in sustainability reporting. 02/2022. Link.

3 | SIX: Sustainability Reporting. As of January 2022. Link.

4 | Credit Suisse: SME Survey 2020, p. 23. Link.

5 | DeSimone, S., D'Onza, G. & Sarens, G. Correlates of internal audit function involvement in sustainability audits. P. 568. DOI: 10.1007/s10997-020-09511-3.

6 | The Global Risk Landscape. World Economic Forum. Link.

7 | The Global Risk Landscape. World Economic Forum. Link.